Split the Company into DG Financial Technology and DG Investments

DG will be a better company if it splits into two completely independent entities: DG Financial Technology (Current FT segment + MT segment) and DG Investments (IT segment + LTI segment).

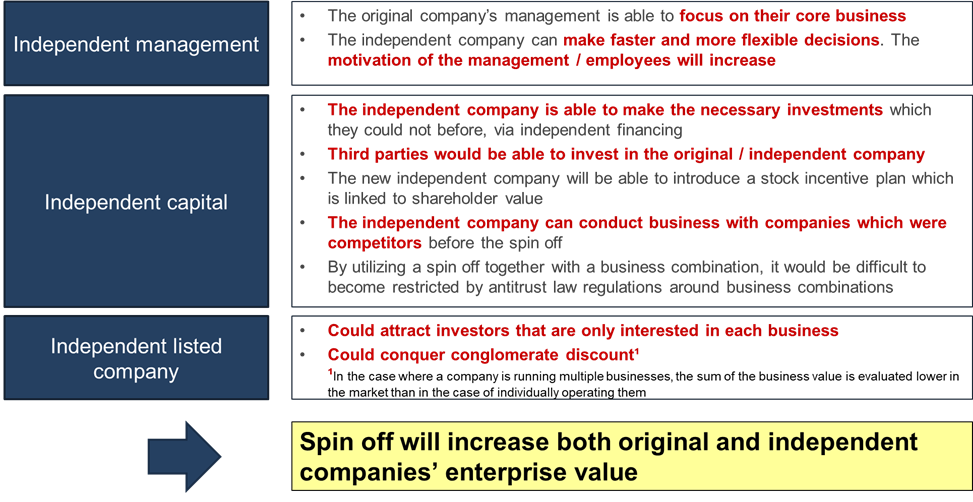

Management will be able to focus more on each business if DG Financial Technology is spun off. Merits of spin-offs include the creation of 1) independent management, 2) independent capital, and 3) an independent listed company.

Stakeholders would be able to benefit from a tax effective spin-off if DG creates DG Financial Technology and DG Investments.

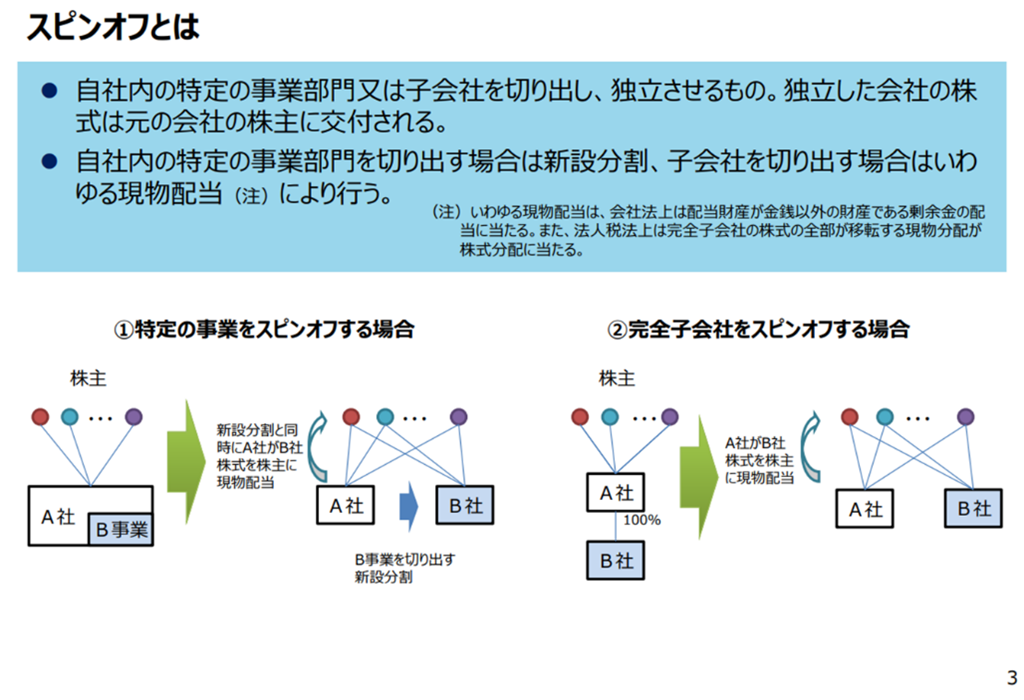

The “分割型分割” scheme would work to spin-off the FT segment and MT segment and create DG Financial Technology.

There will be no equity relationship between DG Financial Technology and DG Investments. This will create two completely independent companies.

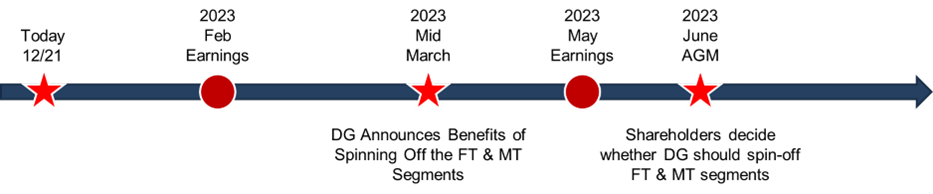

DG should start work now on the spin-off in order to execute in the next fiscal year.

DG’s Board should propose a tax-free spin-off of the FT and MT segments to create DG Financial Technology at the next AGM. This corporate action would significantly increase management engagement with and focus on each of the businesses, and increase the value of DG as a whole. As a milestone, DG should announce the benefits of creating DG Financial Technology by mid-March 2023 so that investors can understand the benefits.

The below would be the illustrative board composition for each of the companies on day one. Additional diversity and experienced Directors would need to be added.