DG Investments Improvement Plan

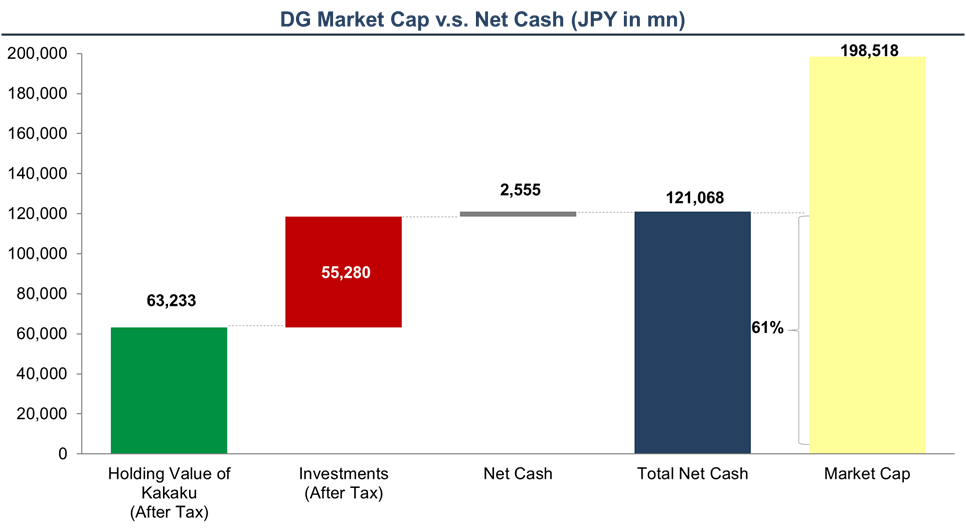

DG’s net cash (incl. Securities) is 61% of its market cap. This has not been factored in, as investors are uncertain whether the Company will return capital.

Further Expand the Fund Business

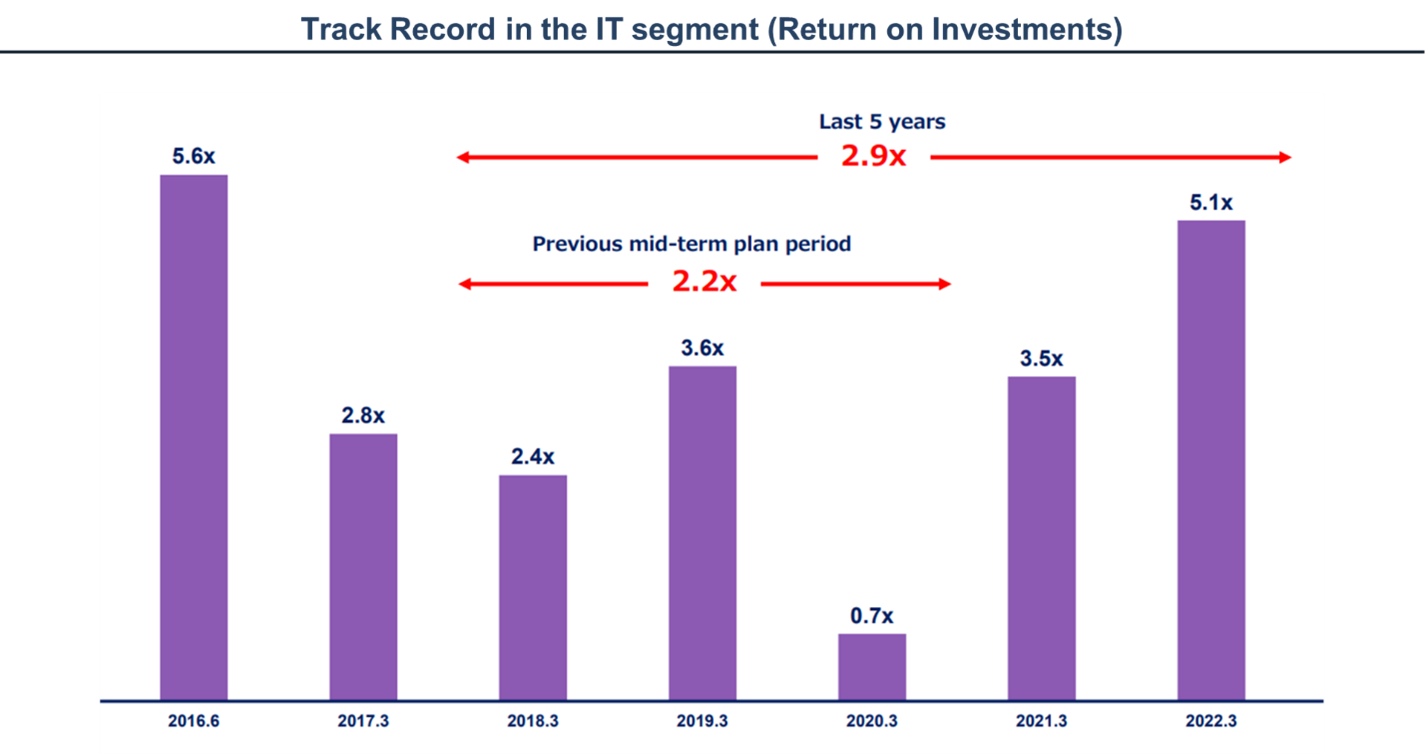

IT segment has strength in early-stage startup investments. The company has been successful in the market and the average return on investment has been 2.9x in the last 5 years. The Company has not been capitalizing on this track record.

The IT segment with its strong platform has been able to make interesting investments overseas.

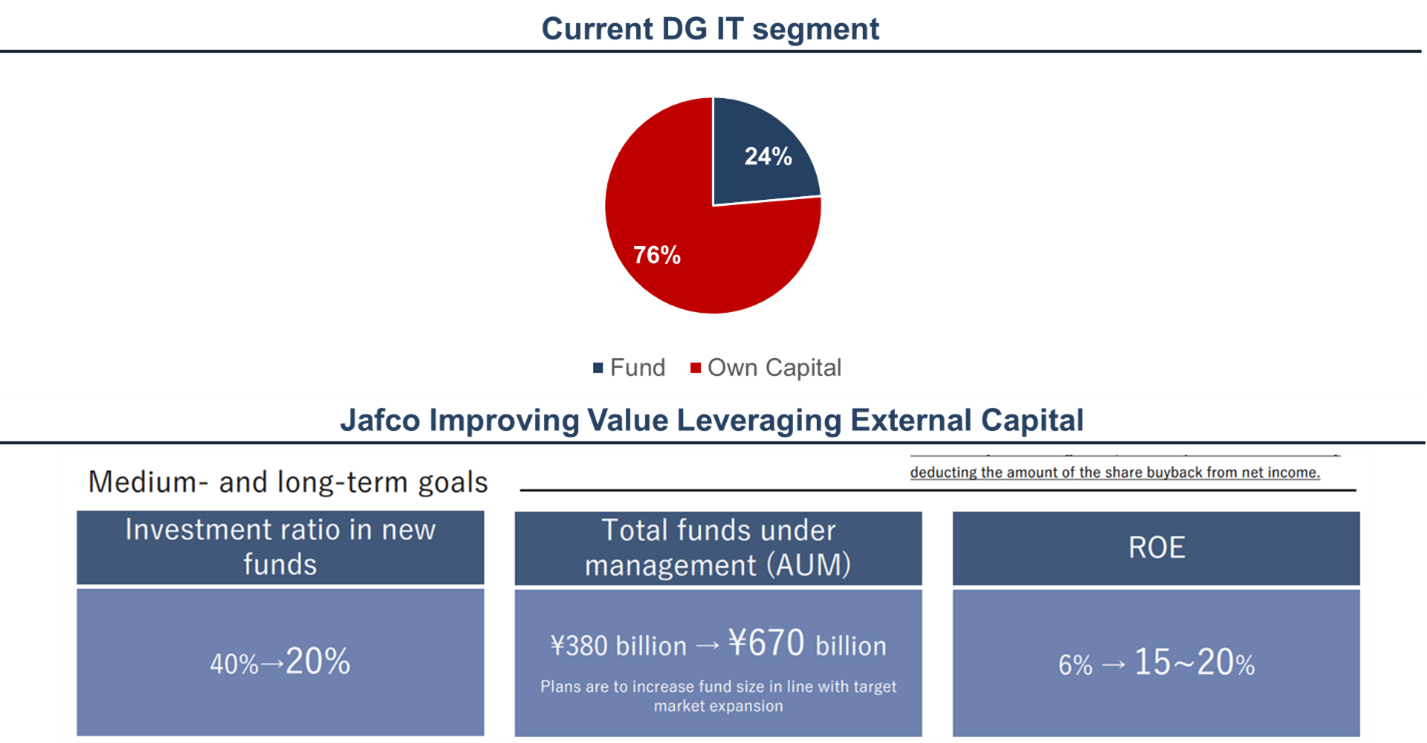

DG has not been able to capitalize on the great performance of the IT segment. Only a small portion of the business is in the fund business.

DG is currently focused on using its balance sheet to invest in start ups (76% of investment is using own capital). Since DG has a great track record and platform to invest, we believe DG Investments could expand the fund business further. DG’s competitor, Jafco Group Co., Ltd. (“Jafco”) recently announced plans to use more external capital to grow its fund business.

The growth market has been weak globally this year amid rising interest rates. This will provide DG Investments with great opportunities and time to prepare.

Sell Kakaku Shares

DG has been invested in Kakaku since 2002. However, historically, DG has not sought any synergies with Kakaku until it announced a plan to do so recently. We believe this is proof that there are no synergies between DG and Kakaku.

DG Can Maintain Its Relationship with Kakaku, Regardless of Equity Ownership

DG should have a relationship with Kakaku regardless of the equity ownership. We believe DG could have a business alliance with Kakaku, regardless of the equity ownership.

We believe having Mr. Hayashi as a cross-chairman for both DG and Kakaku is preventing DG from exiting its investment in Kakaku. Mr. Kaoru should step down from his role as Chairman of Kakaku.

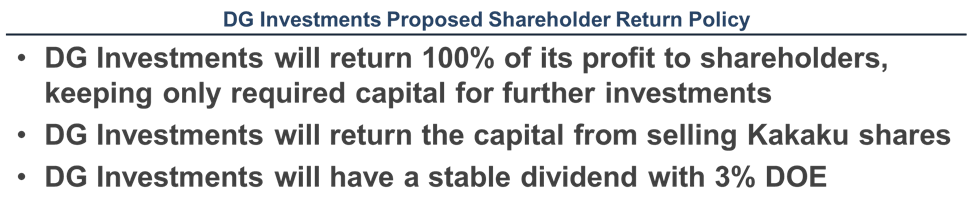

Focus on Shareholder Returns

DG has been invested in Kakaku since 2002. However, historically, DG has not sought any synergies with Kakaku until it announced a plan to do so recently. We believe this is proof that there are no synergies between DG and Kakaku.

DG Investments could perform like Jafco if it successfully returns capital to shareholders through income gain. Selling Kakaku could be a source of income gain while DG Investments prepares for further growth.

DG Investments would be valued JPY2,761 per share.

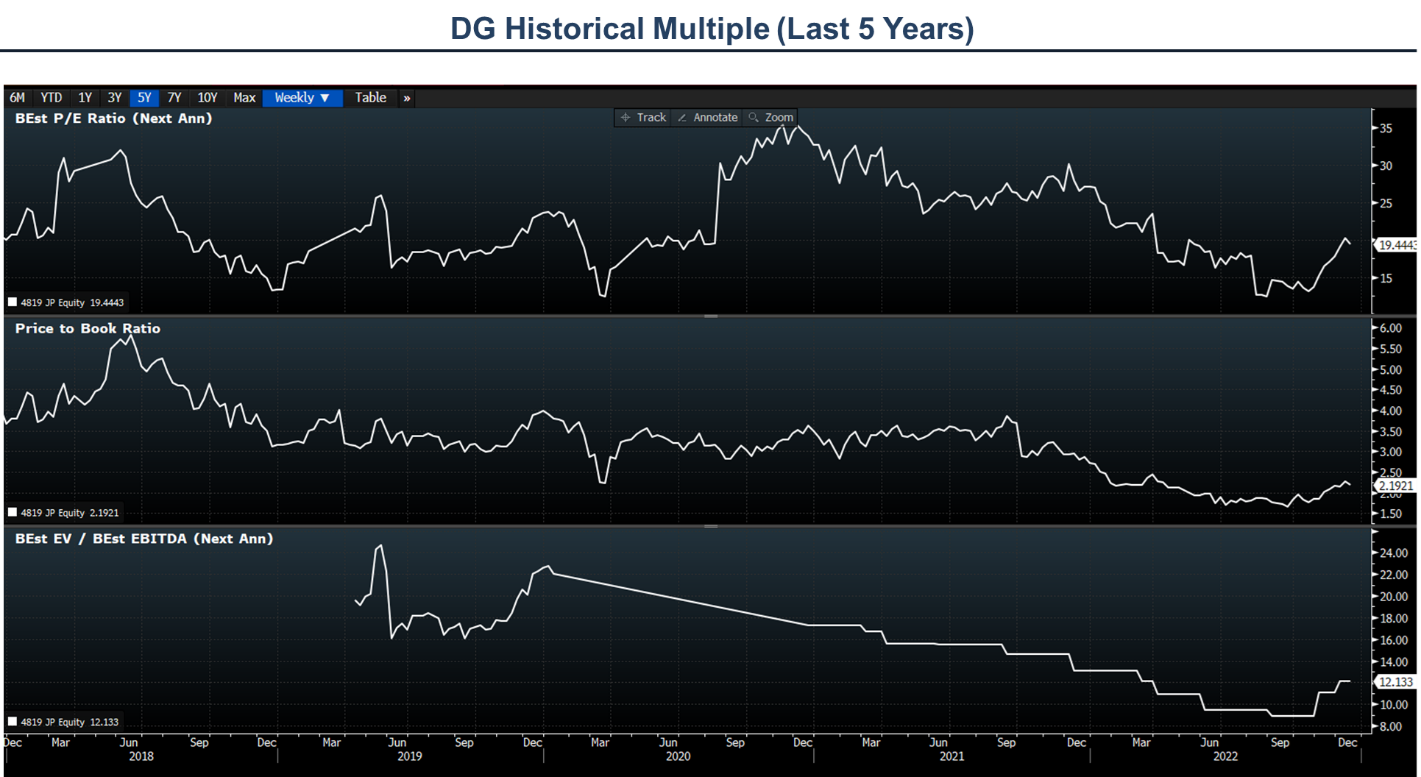

DG is at its historical low on all the valuation metrics. We believe it is a great time to buyback shares.