DG Financial Technology Improvement Plan

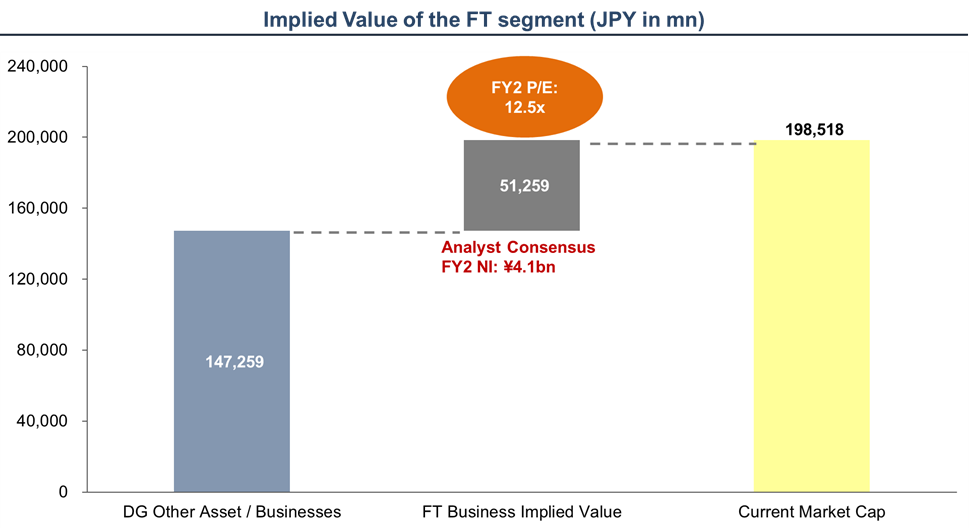

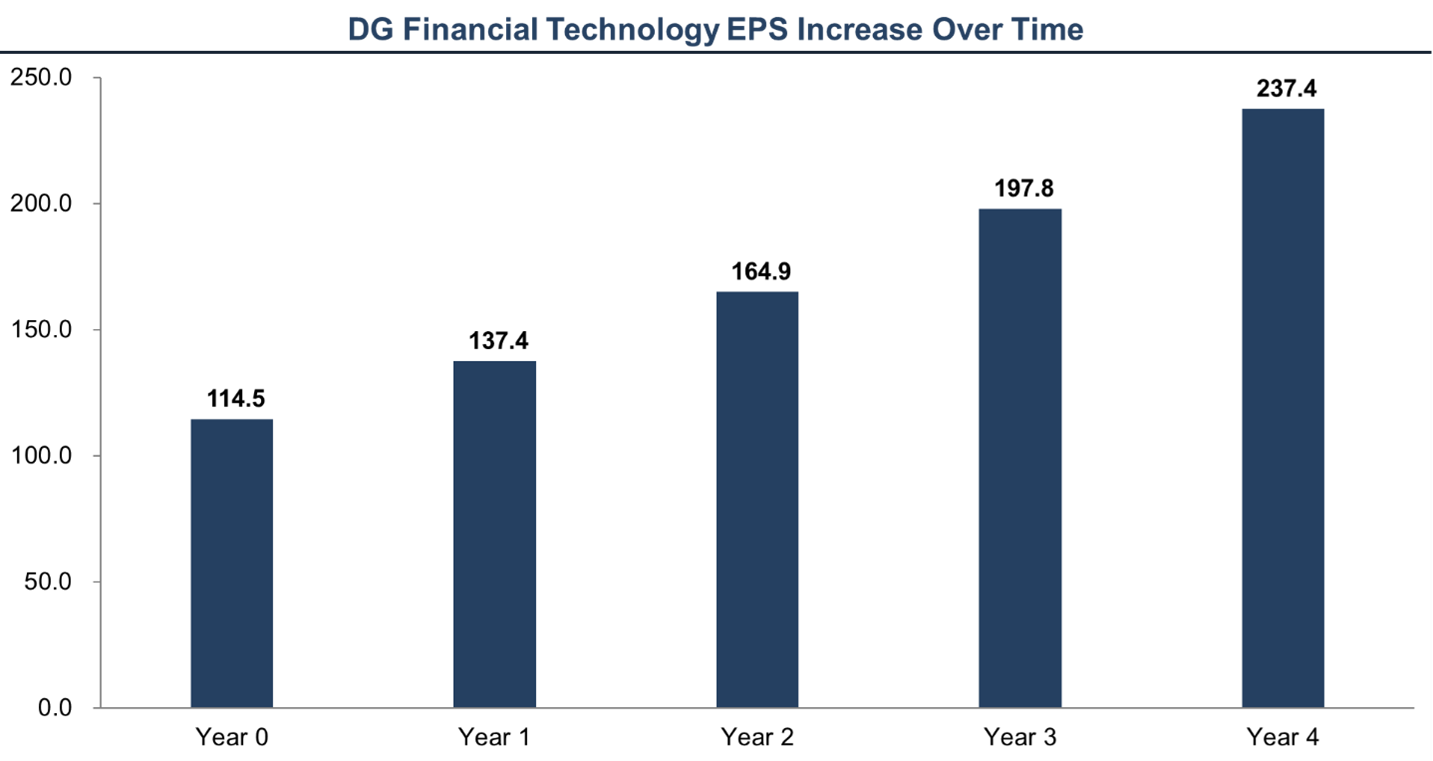

The implied FT segment value is ¥51bn, stripping out all the other DG businesses. This implies a 12.5x FY2 P/E multiple, which is not a multiple which should be applied to a business where the profit grows at a 20% CAGR.

Implementing clear growth plan will substantially increase value of the FT segment.

Strengthen FT Sales

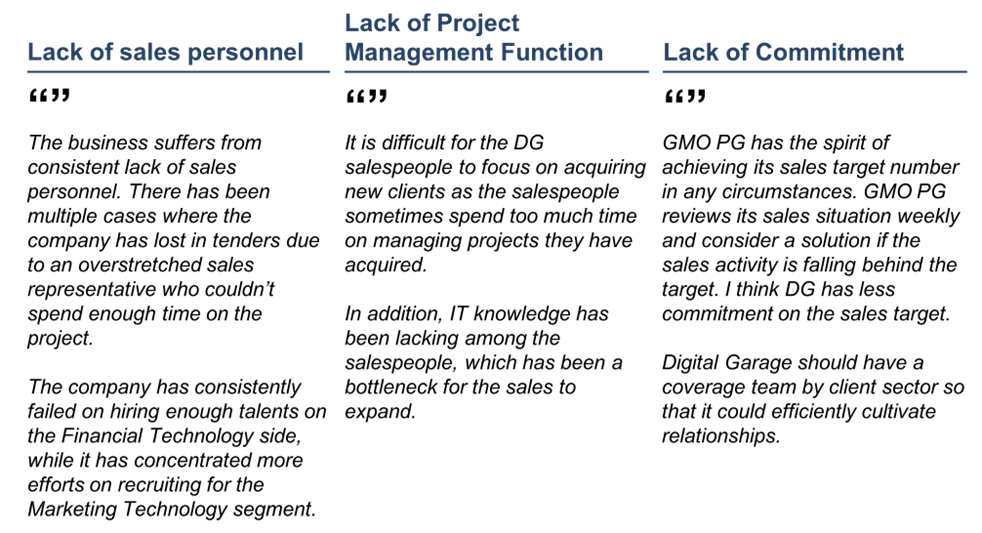

Multiple experts suggest sales issues at DG.

The growth of sales in the market has been driven by growth in the number of employees. DG should further accelerate hiring of sales and project management staff to grow the business.

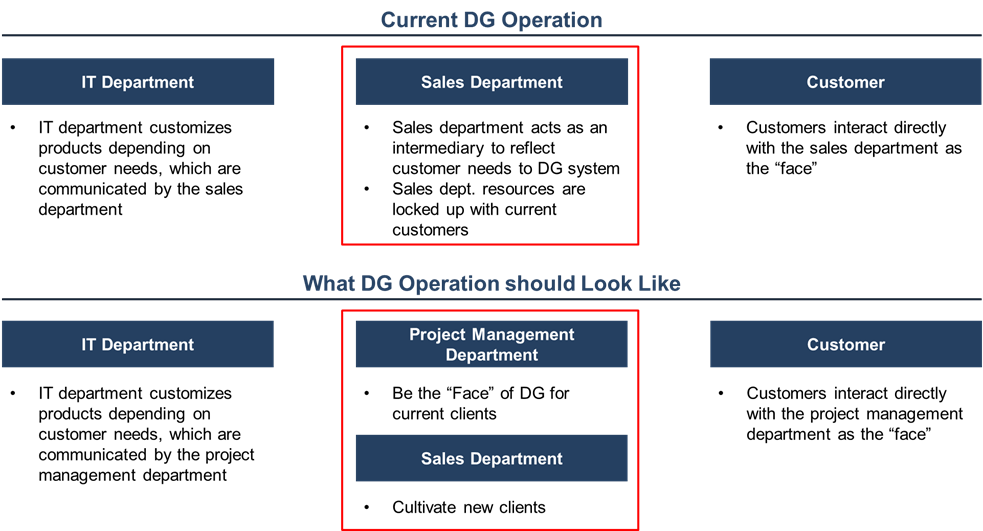

One of the issues in DG’s sales department is that when the sales managers acquire new clients, they tend to become the client’s project manager, which makes it difficult for them to acquire additional new clients. DG should create a new department focused on project management so salespeople can focus on acquiring new clients.

DG currently does not have any sales team dedicated to specific sectors.

Since there is required customization for each sector, we suggest DG rebuild its sales teams to develop expertise in each sector.

With more focus in the sales force, DG’s profit could grow 150%.

Hire a Director with Sector Expertise

Current DG Board does not have any specialists with experience in the Payment Service Provider industry. We believe someone who could better manage the FT segment and hold management accountable for growth with significant payment service provider experience should be included in the Board. In addition, someone who has strength in managing the sales department could significantly increase value.

Realize Synergies between the FT Segment and MT Segment

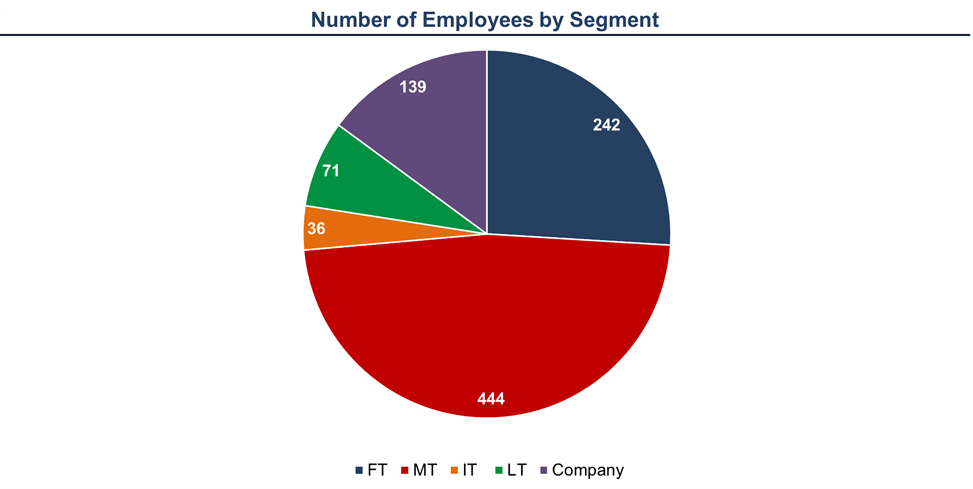

The number of employees in the core FT segment only accounts for 26% of total employees, while the MT segment has nearly double the headcount. DG should consider relocating staff to the FT Segment.

The new DG Financial Technology would create further value by realizing synergies. The MT business could expand sales to the FT segment clients, which would in turn boost settlement transactions.

Set Clear Guidance

Due to the overall business performance being affected by the volatile IT segment, DG was unable to disclose formal guidance. This will not be the case after the Company splits into two.

DG Financial Technology should provide clear guidance with a bottom-up approach. This would further increase the commitment to the guidance for management. DG has only provided vague guidance historically, which has been a reason for low commitment and low earnings targets.

Focus on Capital Gain

DG Financial Technology should focus on capita gain. The business could grow 25% CAGR in profit and we believe it makes the most sense for DG Financial Technology to reinvest in the business.

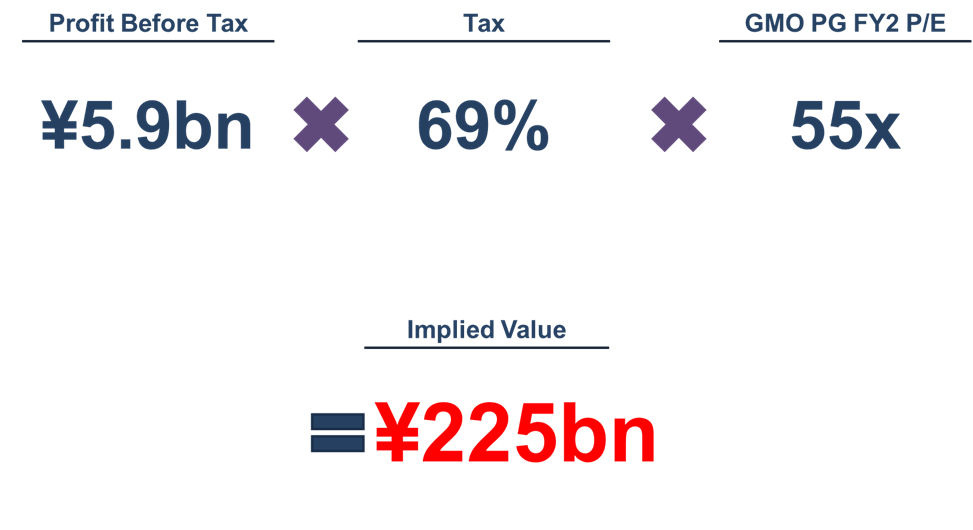

We have strong conviction that DG Financial Technology shares could perform like GMO PG over the last 5 years.

With implementation of our improvement plan for DG Financial Technology, the shares of DG Financial Technology would be priced at JPY5,226.